Financial literacy can be a double-edged sword. My whole life I had kept my eye on the bottom line. Early on, this served me greatly. It forced me to be creative and do more with less. It forced me to prioritize. I would relinquish money only for what I felt was truly important, all else would have to do without.

As I became more secure in my career, my existential dread, once aimed solely at having enough cash to get by, quickly shifted to ensuring I would never run out of money again. I needed to secure financial independence as quickly as I could, then I could worry about enjoying my life. Any dollar not set aside for this aim felt like a failure.

As a result, I had become emotionally over-leveraged. Each monetary gain felt good, but not as much as the previous one. Or the one before that. Conversely, each setback felt devastating. After awhile I was forced to ask myself what I was really chasing. The unfortunate reality was I didn't know.

Why wasn't I using these gains to live a richer and fuller life? Was this a game that was still worth playing? Had it ever been worth playing? I had worked so tirelessly to serve the mighty dollar, that I never contemplated when I should retake the reins and make it serve me.

What Do Now?

It would be natural to over-correct after this enlightenment. This moment is the only one we're guaranteed, why save for a future that may never come? For better or worse, I couldn't quell my old habits quite so severely. I knew a balance had to be struck. The difficulty lied in finding it.

All interesting breakthroughs occur at the edges. I had already pursued the maximalist route, so all that remained was to explore the minimum. Thus bore my thesis:

How little could I get away with saving while still achieving financial security?

To the Lab 🧪

For this thought experiment, I sought to emulate the laziest (most enlightened?) person I could imagine. This individual starts their career at 25. They skim through their onboarding paperwork, plop down at their desk, and exhibit zero drive to climb the ladder for the next 40 years. Surely this sluggard is hosed come retirement.

Our sole investment vehicle in this simulation is going to be the boring ol' 401k - that tax-form-sounding leech that's siphoning our money away every paycheck. This thing is so boring and obvious, but stick with me.

A Legislative Dub

Thanks to the SECURE act (passed in 2020), every employer that offers a 401k plan must automatically enroll their employees in the plan and set a default contribution amount. You have to specifically opt out to not partake in this. Our hypothetical employee has overdosed on apathy, so he doesn't even bother to uncheck this box.

Run the Numbers

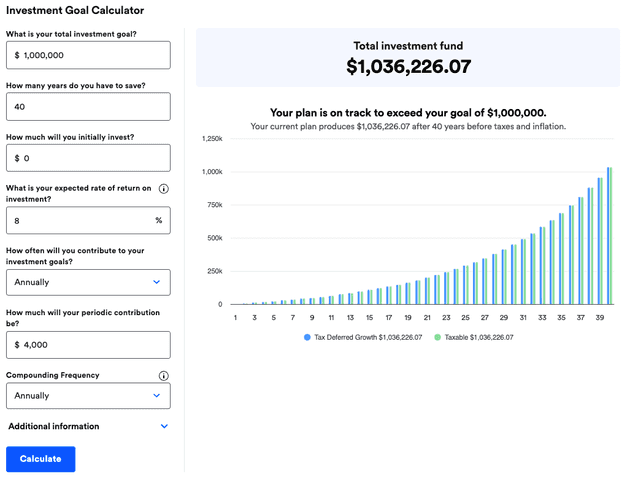

We're going to operate under conservative estimates here to help prove our point:

Salary

We'll allot this dude a salary of $50,000. (The median American woman earned ~$55k in 2023).

401k Contributions

The median 401k match is 4%. Our employee is automatically enrolled at this figure to take advantage of the full match.

Investment Returns

We're going to assume a relatively modest 8% return per year.

Put it All Together and What Does it Spell...

Without even paying attention, we've crossed the magical million mark.

If you would like to play around with the numbers yourself, you can go to Bankrate's Investment Calculator here.

Unlucky SOB

I emphasized already that we wanted to be conservative in our projections, but I'd like to underscore just how conservative we were, while still achieving our goal.

Our hypothetical worker:

never gets a raise

Not even an inflation adjustmentonly starts contributing at age 25

Time is the most important variable here. If he had started his contributions at age 22, he'd net over $300k more.earns a historically subpar ROI

S&P 500 returns for the century hover around 10%.never marries and / or partner never works

Doubt it. You're reading this. You must be attractive.never saves another dime

This person contributes nothing to any other investment vehicle. No IRAs, HSAs, CDs, rental properties, etc.never buys a home

never increases their contributions

Many 401k plans automatically increase your contributions by 1% / year.never receives social security

Love it or hate it, you're probably going to receive something.

never receives an inheritance

Basically luck and fortune never break our guy's way in career, love, or family, and he still retires a millionaire.

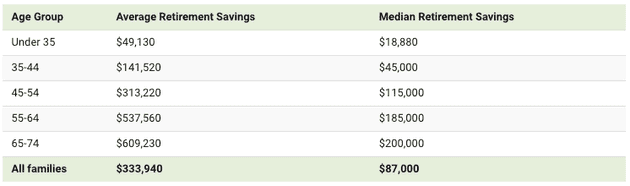

Covet Not Thy Neighbor

Comparison may be the thief of joy, but I think it provides some helpful context. Comparing our $1M portfolio to the average American, we see that we blow the median retiree away by a country mile; and even give ourselves a healthy lead on the average.

It's Going to Be Okay

It's been both liberating and deflating to undergo this exercise. I felt I'd been training my entire life to win the financial game. Then I compared myself to someone who didn't even know they were playing, and they too, won.

Truth be told, my motivation when I sought to write this was to prove to myself that my previous actions made sense - that it was reasonable to keep trying to sprint a marathon. I'm grateful for the cushion and head start my younger self provided, but even more so for the insight that this game is not worth playing forever. Depending on your goals, maybe it's not worth playing at all.

I suppose all life-altering revelations come with their pains and regrets. It can be far easier to persist playing the games we know, rather than risk of pain of realizing we need to change course. Learning that what I had yearned and sacrificed for for so long wasn't nearly as valuable as I had hoped has been truly uncomfortable. With it though, has come the freedom and comfort of knowing I can never go back.