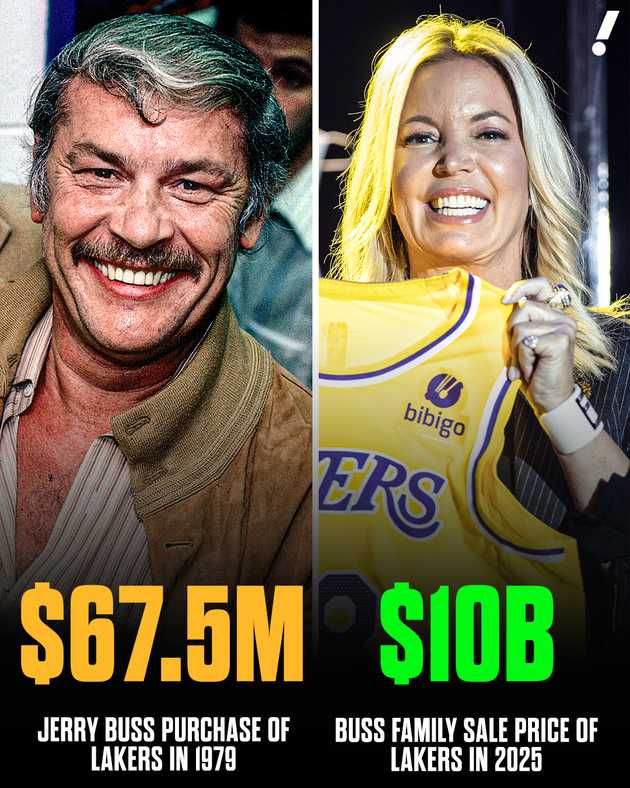

With this summer's sale of the NBA's most popular franchise, a lot of attention has been drawn to the absolutely insane ROI that the Buss family earned after running the team for the last 47 years. The headlines repeatedly iterate an initial purchase price of $67.5 million and a sale price of $10 billion. A whopping 14,715% return.

Sheerly for analytical purposes (not at all to quell my jealousy), I decided to compare the returns of this incredibly sexy investment against our country's most vanilla - the S&P 500. That boring-ass ticker your grandparents are always telling you to put money into so you can retire in 200 years. My eyes glazed over just writing this. But we press on.

Let's suspend all nuance and say that the headline numbers are correct. That would have yielded the Lakers franchise an annualized ~11.5% ROI since the Buss family purchased them. Comparing that to grandma's index fund over the same time period yields 🥁... ~12%.

You could have purchased and ran the world's most popular basketball club for nearly 50 years and still made more money if you were dead.

The purpose of this post isn't necessarily to scrutinize investment decisions. It's to reassure myself that I'm not being "left behind". It's easy to see these staggering figures thrown about for these exclusive assets and feel that the uber-wealthy are leaving us in the dust. While I won't deny that this is often the case, it's not a hard-and-set rule. Boring often wins.

That said, if Stevie B ever wants to sell me a slice of the Clippers, you know I'm taking that call ⛵🏀.

Caveats for the armchair accountants

This section could be vastly longer than the post itself. But I don't care enough to nitpick every detail.

Points that weaken this argument

- the Buss family didn't sell their full ownership, merely the controlling stake

- I don't account for any distributions taken from the business during ownership

- oft-quoted $67.5M purchase price wasn't solely for the Lakers, included The Forum and The Kings 🏒

Points that strengthen my argument

- the Buss family didn't own 100% of the club

- Buss stake wasn't actually sold for $10B. Only a $10B valuation.

- sports teams are a vanity asset. Would any other business, with similar revenues and growth projections, have sold for a similar amount? I doubt it.

- I account for no debt they may have taken on using the club as collateral

People often love to throw out: 'Well after taxes and capital gains 🤔..."

Just stop ✋. Who cares? They made a boatload of money. Good for them.