So much is made of having a good credit score. For some reason, we've all fallen prey to worshipping at the altar of FICO. The mental gymnastics and poor decisions I see in the name of preserving this arbitrary metric of nothingness need to be put to rest. Let's uncover the variables that drive this number, and equally importantly, the ones that don't.

There are 6 metrics that determine your credit score. Each has its own level of impact.

High Impact

- Payment history

- Credit line use

- Derogatory marks

Medium Impact

- Credit age

Low Impact

- Total accounts

- Hard inquiries

Autopay: the Key to Life's (Financial) Problems

You can achieve a perfect rating on the most imperative factors with one simple decision: enabling autopay.

1) Payment history

With autopay enabled, you literally can't miss a payment. Just like that, we've perfected the most important metric.

2) Credit line use

Even if you were to max out your credit cards every month, this metric would come plummeting back down to Reason Town after the payment is posted every month. Second most important metric: done.

3) Derogatory marks

You'll earn these bad boys for things like: bankruptcies, home foreclosures, car repos, etc. But you've automatically paid your bills every month. Negative marks for you: 0.

The "Carrying a Balance" Myth

I'm going to take a quick interlude to finally bury this destructive mind virus.

You 👏 do 👏 not 👏 need 👏 to 👏 carry 👏 a 👏 balance 👏

Ever.

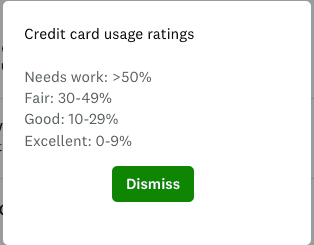

Let's take a look at the credit usage ratings, pulled from Credit Karma:

Look at what the "Excellent" range starts with - 0%! You're actually encouraged to not carry a balance.

Even Credit Karma admits this on their usage page:

You may not be a healer, research scientist, or financial blogger, but by sharing this gospel; a piano melody wafts into your consciousness, your heart thumps with the beat of a kick drum, and 2000's-era vocals pierce your mind. For you too will know how to save a life.

The Less Important Metrics

4) Credit age

Higher is better in this regard, but this will happen naturally with time. Nothing to be actively done here, except occasionally the tip I mention below.

5) Total accounts

Higher is better again, but is not a metric worth putting any effort to. You'll naturally open more accounts over time, so this factor will take care of itself.

6) Hard inquiries

0 is the ideal here. This number will increment anytime you apply for a new line of credit: new card, mortgage, etc. They eventually fall off your report, and as such, are not worth caring about in the long run.

My Only Explicit Tips for Credit Score Boosting

Autopay

The decision that removes all other decisions and ensures your killer score. Even better, requires no effort on your part. What a time to be alive.

Don't Ever Close a Card

In the ever-shifting landscape of consumer finance, you're unlikely to stick with one card for the rest of your life. At least, you almost certainly shouldn't. New and better cards are always around the corner.

But say your current card of choice carries an annual fee. Should you keep paying that, just to keep the account open and your total credit line up? Absolutely not.

Downgrade Unused Cards

If you do find yourself no longer using a credit card, and that card has a fee, you can "downgrade" (technically called a "product change") it to a card that the provider offers with no fee.

I.e., if you have an Amex Platinum, you can downgrade to an Amex Everyday. Chase Sapphire can become a Chase Freedom, etc.

This is free, and now the card will continue to be added to your total credit limit.

Recurring Transactions on Infrequently Used Cards

You've managed to preserve that account, but banks aren't in the business of providing you with unused credit lines in perpetuity. How could they then hope to collect interest on your (non-existent - for us) late payments? Without any activity on an account, the issuer is likely to shut it down. The solution is thankfully easy.

Throw one monthly transaction on a card. Anything automatic and recurring will do: Netflix, utility bill, Spotify, etc. This will prevent your account from being closed. Keeping your total credit limit high and your monthly usage lower.

A Rant Against the Industry

While apps like Credit Karma are great for helping you monitor your credit, they manipulate you by providing too much data about your score. They'll communicate each minute change to provoke you into action - namely, opening a new line of credit. This is all noise.

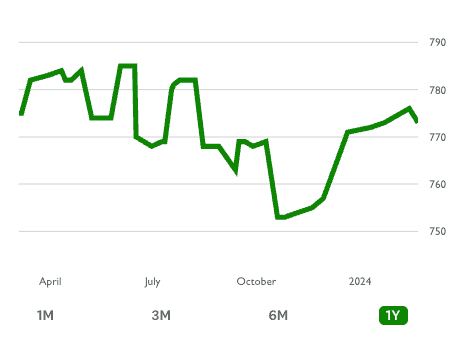

Here is my score graphed over the last year:

What happened in late October to cause a 15 point drop? And surely I must have done something horrid to merit a 30 point drop from peak to trough! I honestly don't know, but it doesn't matter.

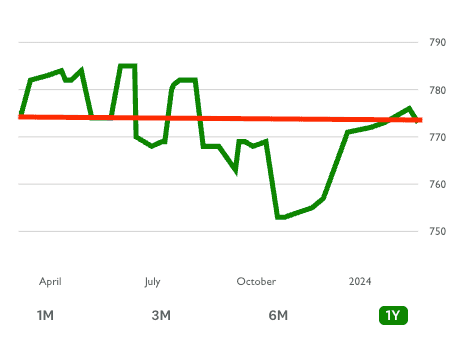

Wanting to be a good data scientist, I did manage to extrapolate this insight:

The net result was flat over a 12-month period. But inactivity is seldom good for sales commissions. To quote Buffett, "Don't ask a barber if you need a haircut," and don't ask a credit affiliate if you need another credit line.

The net result was flat over a 12-month period. But inactivity is seldom good for sales commissions. To quote Buffett, "Don't ask a barber if you need a haircut," and don't ask a credit affiliate if you need another credit line.

Do It For Love

We'll end this sermon on a lighter note. Per the Fed, you're more likely to find and stay with a partner the higher your credit score is. Not only have we conquered credit, but we found love in the process.

Wrapping Up

As we now see, achieving an ideal credit score is nothing more than making a few good decisions upfront, and letting the compounding power of time take care of the rest. I hope I've now freed up even a few moments of your life to focus on infinitely more important things.